To address the economic damage caused by the Corona crisis (Covid-19), the grand coalition has passed a multi-billion dollar stimulus package to strengthen the economy.

As part of this stimulus package, a reduction in the value-added tax, for a limited period, was decided.

This change therefore applies to all businesses and also affects online entrepreneurs and online commerce.

In this article, we would like to inform you about the upcoming changes and explain the necessary settings for sales tax / VAT in WordPress & WooCommerce.

Note on the article:

When we talk about value added tax in the blog article, we are of course referring to sales tax. We have chosen to use the colloquial term, as this is often more common.Please note that we do not offer tax advice. This article does not constitute tax advice and does not claim to be complete. If you have any tax-related questions, please contact your tax advisor or the relevant tax office.

Disclaimer

Table of contents

- How and when will the VAT change?

- Value added tax for small business according to §19 UStG

- Important for the correct calculation of the VAT is the time of the service or delivery (service date)

- How to implement the VAT reduction in WooCommerce

- Manually adjust tax rates in WooCommerce

- Import the new VAT rates directly into WooCommerce

How and when will the VAT change?

At the moment, the corona-related reduction of VAT is planned for a limited period of time. The VAT is to be reduced from 01.07.2020 up to and including 31.12.2020, which corresponds to a full 6 months.

During this period, VAT is to be reduced by 3% for the regular VAT rate and by 2 % for the reduced VAT rate.

As a rule, the reduced VAT rate applies to products for everyday use and basic supplies.

Value added tax from 01.07.2020 to 31.12.2020

VAT normal: 16% instead of the usual 19%

VAT reduced: 5% instead of the usual 7%

The value added tax is a mandatory information on invoices

For those who, due to the upcoming changes in VAT, have the idea of hiding the VAT on invoices or in orders in the store, or not displaying the applied rates, the following advice should be given:

The value added tax and the calculated rate are mandatory information on invoices. The only exceptions are small businesses according to the following small business regulation §19 UStG, which must then be noted on the invoices as a substitute for the VAT.

Value added tax for small business according to §19 UStG

Online store operators who fall under the small business regulation according to §19 UStG. do not have to worry at this point. As a small business owner, you do not show any sales tax / VAT on your invoices and therefore do not pay it to the tax office.

This regulation remains in place, if applicable to your company.

Important for the correct calculation of the VAT is the time of the service or delivery (service date)

Just changing the VAT rate in itself is not a big technical or administrative problem and can be implemented very easily even in online stores like WooCommerce.

However, what makes the matter a bit more difficult is the fact that for the calculation of VAT the decisive point in time (date of performance) is the time at which the delivery is made or a service is or was performed.

Below are two examples of how the VAT rate is determined and what role the date of performance plays in this:

Performance in June 2020 & Invoice in July 2020

You carry out a miscellaneous Performance in June 2020 and thus before the VAT reduction. You issue the invoice to your customer in the July 2020 and thus after the reduction in value-added tax.

However, as described above the service date, in this case June 2020. Accordingly, the Your customer an invoice with 19% VAT.

Performance in December 2020 & Invoice in January 2021

You perform a service for a customer or Delivery in December 2020 and thus after the VAT reduction by. However, your customer will receive the invoice for the delivery / service only in the January 2021. As things stand, the original VAT of 19% will apply again from 01/01/2021. Thus, the accounting is done after the tax increase.

The date of performance or delivery also applies herewhich would be in the period of the reduced VAT. So in this case your customer will receive a Invoice with 16% declared VAT.

The problem version - when it is more confusing ...

You should definitely keep this principle in mind when making settings in your WooCommerce online store.

The easiest way to comply with this principle is to have the ability to make payments, invoices and ship goods in a timely and cohesive manner.

In the current constellation, certain problems are foreseeable in which, for example, payments and invoicing in the online store are made in May, but delivery is not made until June.

According to our knowledge, an invoice correction would be necessary in this case with the delivery in June. For this reason alone, it will be easier for many retailers to leave the gross prices at the same level so that they do not have to make compensation payments in the event of invoice corrections.

However, we strongly recommend that you contact your tax advisor regarding this constellation during the transition period and clarify which taxes should be calculated or how to proceed with the process.

How to implement the VAT reduction in WooCommerce

In addition to the mere change of the VAT rate, please be sure to follow the above mentioned principles according to the VAT calculation based on the date of service or delivery.

Especially during the transition phase, you may need to make manual invoice corrections.

Manually adjust tax rates in WooCommerce

The easiest way is manual adjustment of tax rates directly at the above mentioned cut-off dates.

If you have set your prices in the store as gross prices, the gross price will be used unchanged by the system and only the VAT rate included in it will change.

To customize the tax rates, go to the following menu in WordPress:

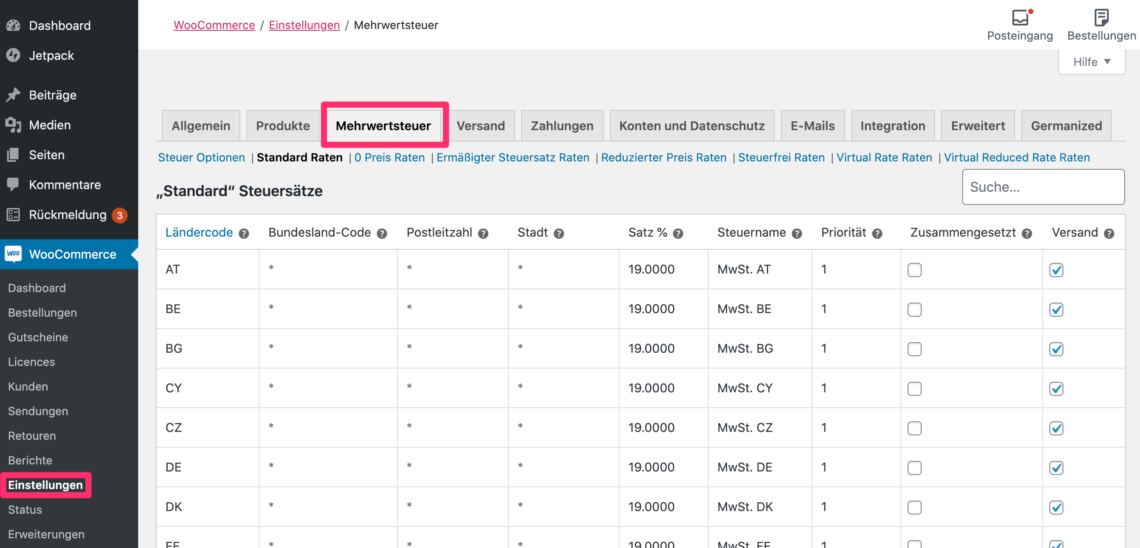

WooCommerce > Settings - there you select at the top of the tabs "Value added tax" from.

In this dialog you will now find the tax options and can use the links, below the tabs, to access the different tax rates.

For example, click "Standard rates" to customize the normal VAT rates for your WooCommerce store.

Import the new VAT rates directly into WooCommerce

We have prepared two CSV files for you to import the new VAT rates, you can easily import them into WooCommerce.

Proceed as follows:

WooCommerce > Settings - there you select at the top of the tabs "Value added tax" from.

Below the tabs you now select the desired tax rate, "Standard rates" generally includes the standard tax rate of 19%, which must be reduced to 16%. "Reduced tax rate rates" usually includes the reduced tax rate of 7%, which must be reduced to 5%.

Attention: The names of the tax rates can be freely defined in WooCommerce. Make sure that you customize the correct rates. These can also have different names than the ones mentioned above.

When you have selected the correct tax rate and the table is in front of you, proceed as follows:

Select the required tax rate and download the import file:

How the import works

1. save the current tax rates

Click below the table on "Export CSV file". Keep the exported CSV file safe, you can use it at the end of the year to restore the old tax rates.

2. delete the existing entries

Select the first entry from the list (just click on it), this should become slightly yellowish. Now click with pressed "Shift" key on the last entry in the list, now all table rows should be marked yellowish and thus selected.

Now click the "Remove selected row(s)" and then click on "Save changes„.

3. import taxes via CSV file

After deleting the old tax records, click "Import CSV file" on the right below the table.

In the "Select a file from your computer:"Now select the CSV file containing the 16% or 5% tax rates. Afterwards click on "Upload and import file", ready!

Once the old tax rates of 19% or 7% apply again, simply use your in Step 1 exported file and thus perform steps 2 and 3 again.

If you are having trouble implementing VAT reduction in your WooCommerce system, we can help you with the work.